Understanding the Legal Status of Cryptocurrency and Betr in Texas

Introduction

Texas is rapidly emerging as a national leader in the regulation and adoption of cryptocurrency. Recent legislative actions, including the establishment of the Texas Strategic Bitcoin Reserve and passage of multiple cryptocurrency-related bills, have positioned the state as a pro-business hub for digital assets. This article provides an in-depth analysis of the legal status of cryptocurrency and platforms such as Betr in Texas, while offering practical guidance for those seeking to invest, operate, or participate in the state’s crypto ecosystem.

Is Cryptocurrency Legal in Texas?

Cryptocurrency is

legally recognized

and regulated in Texas. In 2021, Texas passed House Bill 4474, known as the Texas Virtual Currency Bill (TVCB), which amended the state’s Business & Commerce Code to recognize the legal status of virtual currency. The law provides a clear definition of digital assets and subjects them to Texas commercial regulations, ensuring legal rights for cryptocurrency holders and safer conditions for investors

[1]

. As of September 2021, the TVCB explicitly legitimizes virtual currencies and sets out regulatory protocols for businesses and investors operating in the sector.

Additionally, the Texas Department of Banking issued Memorandum 1037, clarifying the regulatory treatment of virtual currencies under the Texas Money Services Act. This memorandum provides guidance for businesses seeking to engage in cryptocurrency-related activities and outlines requirements for compliance with state law [1] .

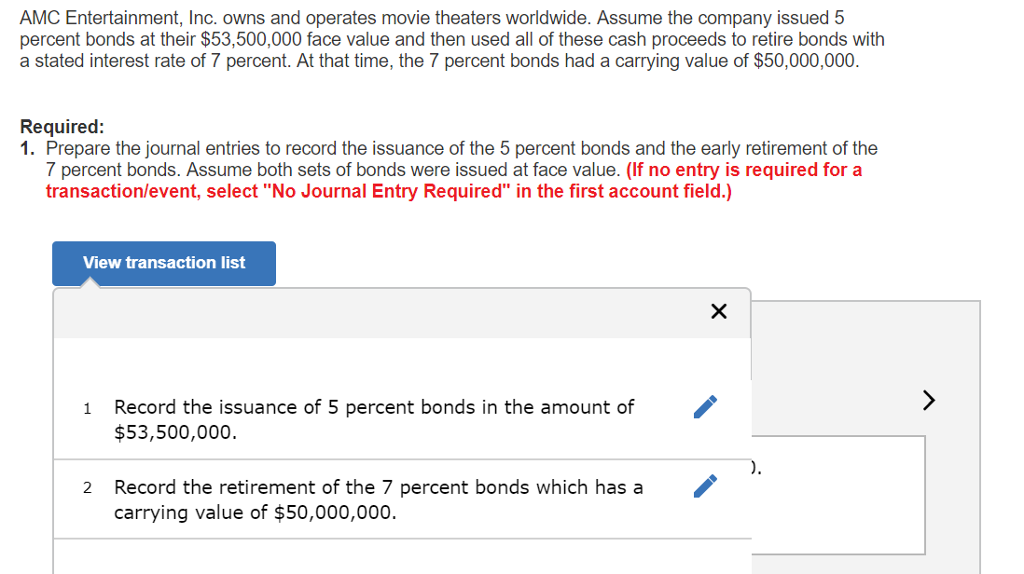

Recent Legislation: Texas Strategic Bitcoin Reserve

In June 2025, Texas Governor Greg Abbott signed Senate Bill 21 (SB 21), establishing the Texas Strategic Bitcoin Reserve. This state-managed fund is designed to hold Bitcoin as a long-term investment and serve as a hedge against inflation and economic volatility. The Reserve is managed by the Texas Comptroller of Public Accounts and is overseen by a five-member advisory committee, which includes cryptocurrency investment professionals [2] , [3] .

Only cryptocurrencies with an average market capitalization of at least $500 billion are eligible for inclusion in the Reserve, making Bitcoin the sole asset at present. The Reserve is funded through legislative appropriations, investment proceeds, and voluntary cryptocurrency donations. Importantly, the Reserve operates independently of Texas’s general treasury system, providing transparency and stability for long-term financial planning [3] .

Source: punters.com.au

Betr and Legal Status in Texas

As of August 2025, there is

no specific reference in Texas law to Betr

-a platform or service that may be related to cryptocurrency, online betting, or digital financial products. The legal status of Betr in Texas depends on its business activities:

Source: zealousadvocate.com

-

If Betr is a cryptocurrency service or exchange

: It must comply with the Texas Virtual Currency Bill and the Texas Money Services Act. This includes registration, consumer protection protocols, and operating within the commercial laws governing digital assets [1] . -

If Betr is a betting or gambling platform

: Texas maintains strict laws prohibiting most forms of online gambling, including sports betting and casino-style games. Unless Betr has licensing from Texas regulatory authorities, such operations are likely

not legal

in the state. For verification, consult the Texas Department of Licensing and Regulation or the Texas Attorney General’s office.

For businesses or individuals considering Betr or similar platforms, it is crucial to review the nature of the service and consult legal counsel specializing in Texas digital asset law. Many reputable law firms and regulatory bodies in Texas offer guidance on compliance, licensing, and risk management.

Practical Guidance for Crypto Investors and Businesses

Given Texas’s supportive stance toward cryptocurrency, investors and businesses have several pathways to engage legally in the industry:

Step-by-Step Compliance for Cryptocurrency Platforms

-

Confirm business activity

: Determine whether your platform offers cryptocurrency exchange, wallet services, or other financial products. Each activity may be subject to different regulatory requirements. -

Register with the Texas Department of Banking

: For money service businesses or cryptocurrency exchanges, registration and compliance with the Texas Money Services Act is required. Search for “Texas Department of Banking cryptocurrency registration” for official guidance. -

Comply with consumer protection protocols

: Implement anti-fraud measures, maintain transparency in operations, and ensure customer funds are protected. -

Abide by commercial regulations

: Follow laws set forth under the TVCB and recent statutes, including proper disclosures, reporting, and adherence to anti-money laundering (AML) and know-your-customer (KYC) standards. -

Monitor federal developments

: Federal regulations regarding digital assets are evolving. Stay informed through resources such as the U.S. Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC).

For guidance, contact the Texas Department of Banking, or consult reputable law firms specializing in cryptocurrency law, such as Freeman Law or Bracewell LLP.

Alternative Approaches and Resources

Given the legal complexity, businesses and individuals may also seek resources such as:

- Legal counsel specializing in digital assets and blockchain technology

- Industry associations, such as the Texas Blockchain Council

- Official state resources-search for “Texas Comptroller cryptocurrency” or “Texas Virtual Currency Bill” for government updates

For those interested in cryptocurrency mining or large-scale operations, Senate Bill 1929 requires facilities with high electricity usage to register with the Public Utility Commission by February 2025. To ensure compliance and avoid regulatory issues, review registration requirements with the Commission [5] .

Challenges and Solutions

While Texas offers a favorable environment for cryptocurrency, challenges remain:

-

Regulatory uncertainty

: Federal changes may impact state-level initiatives. Investors and businesses should monitor legislative updates and seek legal advice before making significant commitments [4] . -

Security and risk management

: Digital asset investments carry inherent risks, including volatility and security threats. Implement robust cybersecurity protocols, and regularly assess risk exposure. -

Transparency and reporting

: Texas law requires regular reporting for state-managed cryptocurrency funds. Private businesses should emulate these standards to build trust and facilitate regulatory compliance.

To address these challenges, build a compliance team, consult industry experts, and leverage official resources for ongoing education and support.

Summary and Key Takeaways

Texas legally recognizes and supports cryptocurrency, providing a robust environment for investment and innovation. Recent legislation, including the Texas Strategic Bitcoin Reserve, further cements the state’s role as a digital asset leader. However, the legal status of platforms like Betr depends on the nature of their business-cryptocurrency services are regulated and permitted with proper compliance, while gambling-related activities remain strictly controlled. For businesses and investors, following state and federal regulations, seeking expert guidance, and maintaining proactive compliance measures are essential for success in Texas’s dynamic digital asset market.

References

- [1] Freeman Law (2024). Texas Blockchain Legislation Status.

- [2] Bracewell LLP (2025). Boots Down for Bitcoin: Texas Leads the Charge With One-of-a-Kind Bitcoin Reserve.

- [3] Hunton Andrews Kurth LLP (2025). Texas Establishes Strategic Bitcoin Reserve.

- [4] Texas Policy Research (2025). Texas Strategic Bitcoin Reserve: What It Is and What It Means for the State.

- [5] Texas Tribune (2025). Texas utility agency sues AG to avoid releasing crypto data.

MORE FROM couponnic.com