Understanding Specified Service Trade or Business: Key Insights, Eligibility, and Steps to Navigate Tax Implications

Introduction to Specified Service Trade or Business (SSTB)

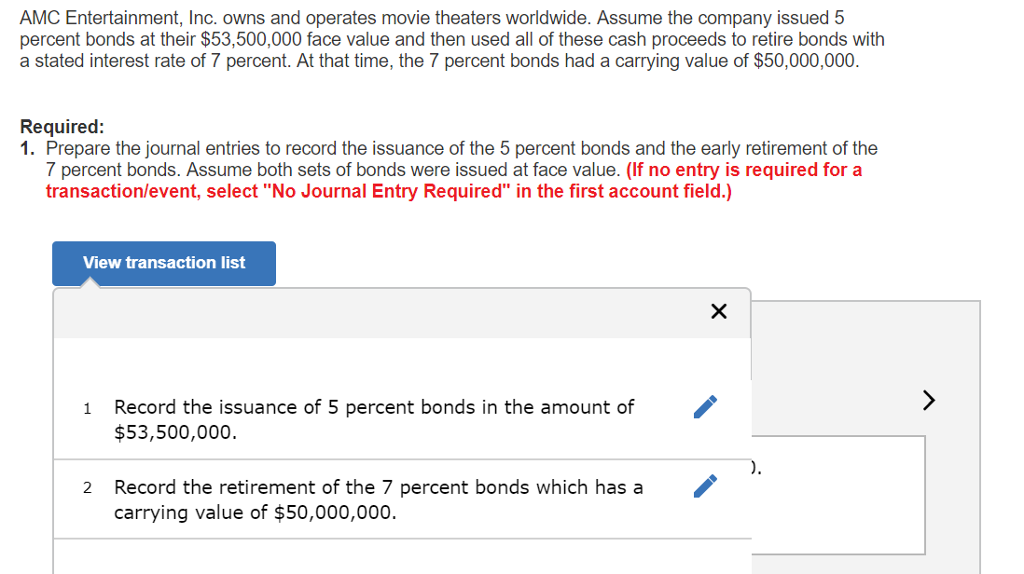

For entrepreneurs, professionals, and business owners, understanding the tax landscape is pivotal for maximizing profits and compliance. One critical concept in the U.S. tax code is the Specified Service Trade or Business (SSTB) . This classification, introduced by the Tax Cuts and Jobs Act (TCJA), plays a crucial role in determining eligibility for the Qualified Business Income (QBI) deduction, which can significantly impact your bottom line [4] . This article explains what an SSTB is, why it matters, how to determine if your business qualifies, and what steps you can take to navigate related tax rules.

What Is a Specified Service Trade or Business?

An SSTB is defined by the Internal Revenue Service (IRS) as a trade or business where the principal asset is the reputation or skill of one or more of its employees or owners [3] . These businesses typically provide services rather than tangible goods. The IRS outlines specific fields that fall under the SSTB classification, including:

- Health

- Law

- Accounting

- Actuarial Science

- Performing Arts

- Consulting

- Athletics

- Financial Services

- Brokerage Services

- Any business where income is from endorsing products, using an individual’s image, or media appearances

- Investing, investment management, trading, or dealing in securities, partnership interests, or commodities

It is important to note that not all service businesses are SSTBs . The defining factor is whether the business relies primarily on the skill or reputation of its people, and whether it falls into the IRS’s listed categories [1] .

Why SSTB Classification Matters: The QBI Deduction

The main reason SSTB status is important is its impact on the Qualified Business Income (QBI) deduction . The QBI deduction, introduced in 2018, allows eligible business owners to deduct up to 20% of their qualified business income from their taxes [4] . However, SSTBs face strict limitations on this deduction, especially as the owner’s income rises.

Source: alamy.com

If your business is classified as an SSTB and your taxable income is above IRS-set thresholds, you may be partially or completely excluded from this valuable deduction. If your income is below certain thresholds, you can still fully claim the deduction. The threshold amounts are updated annually, so it is important to check the latest IRS guidance or consult a qualified tax advisor [2] .

Eligibility Criteria and Income Thresholds

Whether your business qualifies for the QBI deduction depends on both your business type and your total taxable income. Here are the current (2025) basic thresholds:

- If your taxable income is below $160,725 (single) or $321,400 (married filing jointly), your SSTB is treated like any other qualified business, and you may claim the full QBI deduction.

- If your taxable income is between $160,725 and $210,725 (single) or $321,400 and $421,400 (married filing jointly), the deduction is phased out. Only a portion of your income qualifies for the deduction.

- If your taxable income is above $210,725 (single) or $421,400 (married filing jointly), your SSTB does not qualify for a QBI deduction.

These thresholds change annually, so check the IRS website or consult a tax professional for the latest figures [2] .

Examples of Specified Service Trades or Businesses

To clarify, here are real-world examples of SSTBs:

- Law Firm: A partnership providing legal advice and representation. The principal asset is the skill and reputation of its attorneys.

- Medical Practice: Doctors offering health services, where income is based on their expertise and reputation.

- Financial Advisor: A firm giving investment advice based on the knowledge of its advisors.

- Performing Artist: An entertainer or athlete receiving income for performances, endorsements, and media appearances.

In each case, the business earns income primarily from the unique skills or reputation of its people rather than from selling tangible goods [1] .

How to Determine If Your Business Is an SSTB

Determining SSTB status requires careful analysis. Here’s a step-by-step approach:

Source: alamy.com

- Review Your Services: Identify whether your business falls into one of the listed categories (health, law, accounting, etc.).

- Analyze Revenue Sources: Consider if your income depends mainly on the skill or reputation of yourself or your employees.

- Consult the IRS Regulations: Review 26 CFR § 1.199A-5 for detailed definitions and examples.

- Seek Professional Guidance: If unsure, consult a certified public accountant (CPA) or tax attorney experienced with Section 199A and QBI deductions.

Remember, classification can be complex. For borderline cases, detailed documentation and a tax professional’s opinion are essential.

Actionable Steps for SSTB Owners

If you determine your business is an SSTB, consider the following steps to optimize your tax position:

- Monitor Your Taxable Income: Keep your taxable income below IRS thresholds where possible to maximize or retain QBI deduction eligibility.

- Tax Planning: Consider strategies such as increasing retirement plan contributions, managing business expenses, or using defined benefit plans to reduce taxable income.

- Entity Structure Review: Evaluate whether your current business structure (LLC, partnership, S corp) is optimal for your tax situation.

- Stay Informed: Tax laws change. Regularly check the IRS website or trusted tax resources for updates.

For specific guidance, you can search the IRS website for “Section 199A Qualified Business Income Deduction” or contact a tax professional who specializes in small business or pass-through entity taxation.

Potential Challenges and Solutions

Many business owners face challenges in determining SSTB status, especially if their operations cross multiple fields. Some common issues include:

- Mixed Service and Product Businesses: If you offer both services and products, you may need to separate business activities for tax purposes. The IRS provides guidance on identifying and reporting split activities.

- Income Threshold Management: Keeping income below the threshold can be difficult for rapidly growing businesses. Advance tax planning and working with a CPA can help optimize your deductions.

- Complex Ownership Structures: If you have multiple owners or are part of a larger entity, calculating qualified income and applicable portions for QBI deduction can be complex. Professional advice is strongly recommended.

Alternative approaches may involve restructuring the business, reevaluating compensation strategies, or developing new revenue streams that are not SSTB-classified. Each situation is unique and should be addressed with tailored planning.

Alternative Pathways for Tax Optimization

If your business is classified as an SSTB and you exceed the income threshold, you still have options:

- Increase Retirement Contributions: Maximize contributions to retirement plans to lower taxable income.

- Utilize Spousal Income Planning: For married couples, income-splitting or strategic compensation may help keep taxable income below relevant thresholds.

- Explore Non-SSTB Ventures: Pursuing additional business lines that do not fall under SSTB can diversify income streams and improve your overall tax position.

Always discuss these strategies with a qualified tax advisor to ensure compliance and effectiveness.

Key Takeaways

Understanding whether your business is a Specified Service Trade or Business is essential for tax planning and maximizing the QBI deduction. SSTBs include many professional service fields and face unique tax deduction limits based on income. Diligent classification, proactive tax planning, and regular consultation with tax professionals are crucial for business owners in these fields. For official guidance, always refer to the IRS or consult a licensed tax expert.

References

- [1] Drake Software (2024). QBI Deduction – Specified Service Trade or Business (SSTB).

- [2] Intuit Accountants (2025). What is Specified Service Trade or Business (SSTB).

- [3] Cornell Law School (n.d.). 26 CFR § 1.199A-5 – Specified service trades or businesses.

- [4] Huckleberry (n.d.). SSTB: What Does Specified Service Trade or Business Mean?

- [5] IRS (2024). Definition of trade or business.

MORE FROM couponnic.com