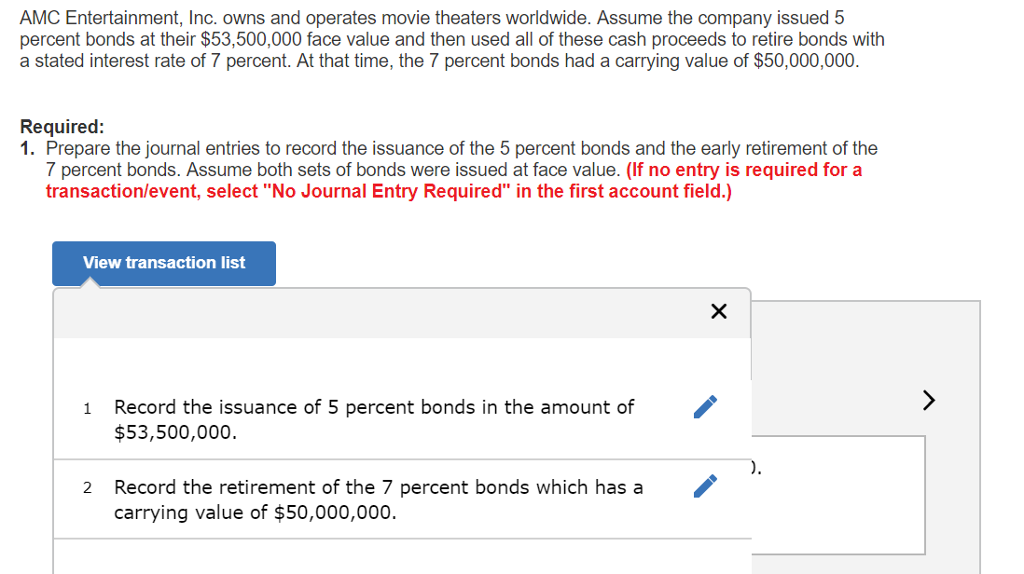

Structured Finance Law: Navigating Risk, Opportunity, and Legal Frameworks

Introduction to Structured Finance Law

Structured finance law is a highly specialized field of legal practice focused on designing, documenting, and regulating complex financial transactions that manage risk and leverage on a scale beyond what traditional loans or bonds can handle. These transactions serve major financial institutions, corporations, and investors by isolating assets, protecting against creditor claims, and facilitating access to capital markets. Structured finance law is essential in supporting large-scale investments, providing legal certainty, and fostering financial market stability. [1] [5]

Core Concepts of Structured Finance

Structured finance involves pooling various income-generating assets-such as mortgages, car loans, or credit card receivables-into a legal entity known as a special purpose vehicle (SPV) or special purpose entity (SPE) . This entity then issues securities or bonds backed by the cash flows from those assets, offering investors regular payments while isolating their risk from the originator’s financial health. [3] [2]

Three defining elements of structured finance are:

- Pooling of assets : Combining diverse receivables into an asset pool.

- Risk isolation : Delinking the credit risk of the asset pool from the originating company by transferring assets to the SPV or SPE.

- Tranching : Dividing securities into different classes (tranches) with varying levels of risk and return, catering to different investor preferences. [4]

Legal Structures and Protections

The legal framework for structured finance is designed to ensure that the assets transferred to the SPV are protected from the originator’s creditors, especially in the event of bankruptcy. This is achieved through a process known as a “true sale” , where assets are legally separated from the seller. A well-structured true sale means that, if the original company becomes insolvent, the assets remain with the SPV and are not accessible to the company’s creditors. [1]

To further shield investors, the SPV is typically set up so that it cannot enter bankruptcy itself, or its risk of bankruptcy is exceptionally remote. Legal counsel provides detailed opinions to confirm that the structure meets these requirements and that the transaction will withstand legal scrutiny in different scenarios.

Additional legal complexities often arise in cross-border transactions, requiring expertise in multiple jurisdictions, tax law, securities regulation, and bankruptcy law.

Common Types of Structured Finance Transactions

Structured finance law covers a wide range of transaction types, including:

- Securitization : Turning pools of loans or receivables into marketable securities.

- Asset-Backed Securities (ABS) : Securities backed by assets like auto loans, student loans, or credit card debt.

- Mortgage-Backed Securities (MBS) : Bonds backed by pools of residential or commercial mortgages.

- Collateralized Debt Obligations (CDOs) : Complex instruments pooling various types of debt, often including tranching.

- Synthetic structures : Using derivatives to replicate the risk and return of asset pools without direct asset transfer.

Each type requires tailored legal documentation to address risk allocation, regulatory compliance, and investor protection.

Why Businesses and Investors Use Structured Finance

Structured finance enables companies to raise capital more efficiently, diversify funding sources, and manage balance sheet risk. For investors, these instruments offer access to tailored risk/return profiles, often with enhanced yields compared to traditional bonds. By structuring transactions to isolate assets, both companies and investors can benefit from greater certainty, improved credit ratings, and legal protection.

For example, a bank with a large portfolio of auto loans can securitize those loans, sell the resulting securities to investors, and use the proceeds to make new loans. The investors receive regular payments funded by auto loan repayments, while the risk is isolated from the bank’s other activities. [4]

Accessing Structured Finance Services

Businesses seeking structured finance solutions typically work with specialized legal counsel, investment banks, and financial advisors. To begin, you can:

Source: lawtomated.com

- Consult with a law firm specializing in structured finance and securitization. Many international law firms have dedicated teams for these transactions. You may search for firms with expertise by using terms such as “structured finance law firm” or “securitization legal services” in combination with your location.

- Engage with investment banks experienced in structuring and underwriting asset-backed securities or related products. Search for “investment banks structured finance” to identify potential partners.

- Review regulatory guidance from agencies such as the U.S. Securities and Exchange Commission (SEC) or relevant financial authorities in your jurisdiction. You can find official publications and investor information by visiting the SEC’s website and searching for “structured finance guidance” or “securitization rules.”

- For cross-border transactions, consult advisors with expertise in both local and international finance laws, as regulatory requirements and tax implications can vary widely.

It is advisable to request references and verify the experience of any professional before engaging their services. Due diligence is critical, as structured finance transactions are complex and errors can lead to significant financial or legal exposure.

Potential Challenges and Solutions

Structured finance transactions are inherently complex due to the number of parties involved, legal requirements, and regulatory oversight. Common challenges include:

- Asset isolation risk : Ensuring that the transfer of assets is recognized as a true sale and not subject to reversal in bankruptcy proceedings.

- Regulatory compliance : Meeting evolving securities and tax laws, which can differ by country or region.

- Complex documentation : Drafting comprehensive agreements that clearly allocate risk, rights, and responsibilities.

- Investor transparency : Providing clear disclosures and regular reporting to satisfy investors and rating agencies.

To address these challenges, businesses should invest in specialized legal and financial expertise, maintain open communication among all parties, and stay current with regulatory changes. Periodic reviews and audits of structured finance programs are recommended to ensure ongoing compliance and performance.

Alternative approaches for raising capital without structured finance include direct bank loans, issuing traditional bonds, or exploring private equity investment. However, these options may not provide the same risk isolation or capital efficiency as structured finance solutions.

Recent Trends and Developments

The structured finance market continues to evolve, with recent trends including increased automation in asset selection, advances in risk modeling, and greater regulatory scrutiny following the 2008 financial crisis. Policymakers have implemented stricter disclosure and transparency standards to protect investors and enhance market stability. [4]

Growing demand for sustainable investments has led to the emergence of green and social asset-backed securities, which fund environmentally beneficial or socially impactful projects. Investors and issuers should consult with legal counsel to ensure compliance with ESG (Environmental, Social, and Governance) criteria as required by new regulations or investor mandates.

Key Takeaways

Structured finance law offers powerful tools for managing risk and unlocking capital, but requires careful legal structuring, compliance, and expert guidance to achieve the desired benefits. Businesses and investors considering structured finance should engage experienced professionals and stay informed about regulatory developments to maximize advantages and minimize potential pitfalls.

Source: jelvix.com

References

- [1] Miller Thomson LLP (2024). Structured Finance and Securitization Lawyers.

- [2] Schwarcz, S. L. (Duke Law Scholarship Repository). Structured Finance: The New Way to Securitize Assets.

- [3] The University of Law (2024). What is banking and debt finance law?

- [4] Bank for International Settlements (2005). Structured finance: complexity, risk and the use of ratings.

- [5] Appleby Global (2024). Structured Finance Law.

MORE FROM couponnic.com