Suing Your Health Insurance Company for Pain and Suffering: What You Need to Know

Understanding Your Rights: When Can You Sue for Pain and Suffering?

Many policyholders ask whether they can sue their health insurance company for pain and suffering after a claim denial, delayed payment, or bad faith actions. The answer depends on the specifics of your insurance policy, the nature of the insurer’s conduct, and the applicable federal or state laws. In some situations, policyholders may pursue compensation for emotional and physical suffering, but there are important limitations and steps to consider.

What Qualifies as Pain and Suffering in Insurance Disputes?

Pain and suffering refers to the non-economic impact of an insurer’s action or inaction. This includes physical pain, emotional distress, anxiety, depression, loss of enjoyment of life, and other psychological effects related to denied or delayed medical treatment [5] . For example, if a health insurance company unjustly denies a claim, resulting in your inability to access necessary treatments, you may endure physical complications and mental anguish.

However, not all denials or delays qualify. The key factor is whether the insurer acted in bad faith – meaning they unreasonably denied, delayed, or mishandled your claim without a legitimate basis [1] .

Federal and State Law Limitations: The Impact of ERISA

If your health insurance is provided through your employer, your plan may fall under the federal Employee Retirement Income Security Act (ERISA). Under ERISA, your ability to recover damages is significantly restricted : you generally cannot obtain compensation for pain and suffering or punitive damages. Instead, you are usually limited to recovering the cost of denied benefits and possibly attorney’s fees [3] . This rule applies to most employer-sponsored plans, limiting your legal remedies compared to private or individually-purchased insurance policies.

For non-ERISA plans (such as individual policies), state law may allow broader recovery, including non-economic damages for pain and suffering. The specific rules vary by state, so consulting a local insurance attorney is crucial for accurate guidance.

Examples of Bad Faith and Emotional Distress Claims

Courts have recognized several scenarios where policyholders may sue for emotional distress or pain and suffering. These include:

- Unjustified denial of a valid claim

- Unreasonable delays in claim processing

- Failure to adequately investigate a claim

- Misrepresentation of policy terms

- Deliberate or egregious conduct by the insurer

For example, if your insurer repeatedly ignores requests for documentation or fails to communicate about your claim, resulting in missed treatment and worsening health, this may form the basis for a bad faith lawsuit [2] .

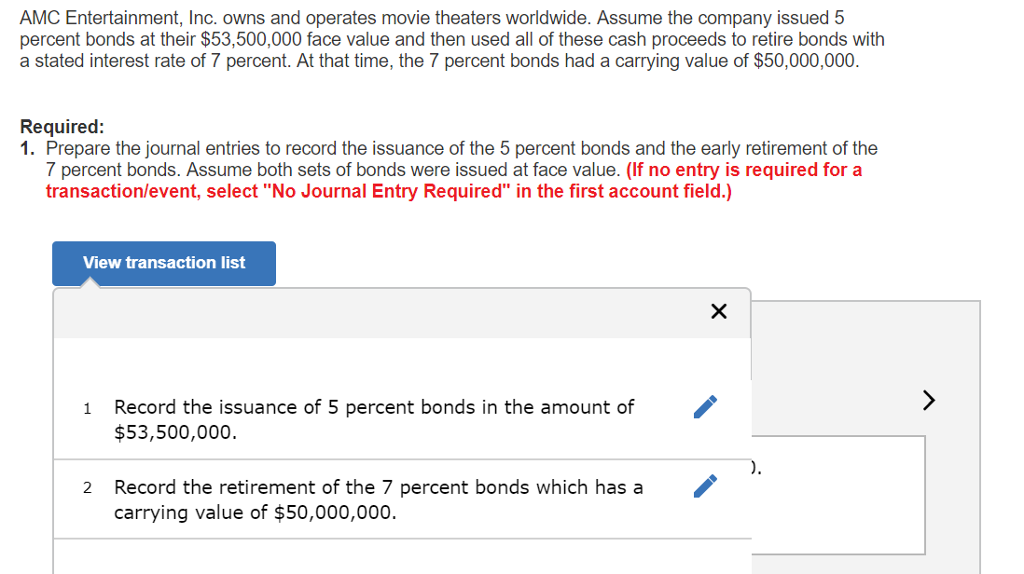

Step-by-Step Guide: How to Initiate a Lawsuit for Pain and Suffering

- Consult an Attorney : Seek a lawyer specializing in insurance litigation. They can evaluate your policy, the insurer’s actions, and your potential claims [1] .

- Exhaust Internal Appeals : Use all appeals processes offered by your insurer. Most policies require this step before legal action is allowed [4] .

- Request and Collect Documentation : Gather all correspondence, denial letters, medical records, and notes from conversations with your insurer. You may need to formally request your full policy and denial reasons in writing.

- External Review : In many cases, you must pursue an independent review (often through a state agency or third party) if appeals are unsuccessful.

- File a Complaint : With your attorney’s help, draft and file a lawsuit in the appropriate court. Your complaint should detail the damages, the pain and suffering endured, and the insurer’s alleged bad faith.

- Settlement Negotiations or Trial : The insurer may attempt to settle. If no agreement is reached, the case proceeds to trial, where a judge or jury will decide if compensation is owed.

Missing any required administrative step may result in your case being dismissed, so careful preparation is essential [4] .

Proving Pain and Suffering: What Evidence Do You Need?

You must link the insurer’s actions directly to your pain and suffering. Key evidence includes:

- Medical records demonstrating physical or mental harm

- Therapist or counseling notes documenting emotional distress

- Written communications showing delays, denials, or bad faith

- Testimony from family members or coworkers about the impact on your life

Courts assess whether the harm was foreseeable and if the insurance company’s conduct was unreasonable or egregious [2] .

What Damages Can You Recover?

Depending on the law that applies and the facts of your case, you may be entitled to:

- Economic damages : Out-of-pocket expenses, lost wages, and denied medical benefits

- Non-economic damages : Pain and suffering, emotional distress, and loss of enjoyment of life (where permitted)

- Punitive damages : In rare cases, for particularly egregious or malicious conduct

Remember, if your policy falls under ERISA, compensation is generally limited to the benefits due and attorney’s fees [3] .

Challenges and Practical Considerations

Litigating against a health insurance company can be complex. Insurers have significant resources and will often contest claims vigorously. Challenges include:

- Proving bad faith or emotional distress can be difficult without strong documentation.

- Complicated laws may limit damages or require specific procedural steps.

- Lengthy legal processes can result in delays before receiving compensation.

To maximize your chance of success, work closely with an attorney, keep meticulous records, and remain persistent in following all required steps.

Source: luzenelhorizonteymas.blogspot.com

Alternative Paths and Additional Support

If you are not eligible to sue for pain and suffering due to ERISA or state restrictions, consider these alternatives:

- File a complaint with your state insurance commissioner or regulatory agency.

- Seek help from nonprofit legal aid organizations specializing in insurance disputes.

- Consult your employer’s human resources department for support with plan appeals.

To locate a consumer protection agency or state insurance regulator, search for your state’s official insurance department website and use terms like “file a health insurance complaint.”

Key Takeaways

You may be able to sue your health insurance company for pain and suffering if you can prove they acted in bad faith , but your rights depend on the type of insurance plan and the relevant laws. Always exhaust all appeals and external reviews before filing suit, collect thorough evidence, and seek experienced legal counsel. If you cannot recover pain and suffering damages under federal law, explore administrative or alternative remedies to resolve your dispute.

References

- [1] Pusch & Nguyen (2024). Can You Sue Your Insurance Company for Pain and Suffering?

- [2] Wocl Leydon (2025). Can I Sue My Insurance Company for Emotional Distress?

- [3] Gianelli & Morris (2020). Can I Sue my Health Insurance Company for Pain and Suffering?

- [4] Morgan & Morgan (2025). How to Sue a Health Insurance Company

- [5] The Wilhite Law Firm (2024). Can I Sue for Pain and Suffering in Texas?

MORE FROM couponnic.com