Understanding the Cloud Technology Behind Modern Payroll Systems

Introduction: The Shift to Cloud-Based Payroll Systems

Modern businesses are increasingly turning to cloud-based payroll systems to automate and streamline their payroll processes. By leveraging the power of cloud computing, companies gain real-time access, enhanced security, and seamless integration with other business functions. But what specific cloud computing technology underpins these payroll solutions, and what practical steps are required to implement them effectively?

What Is Cloud-Based Payroll Technology?

When a company uses a cloud-based payroll system, it relies on Software as a Service (SaaS) , a form of cloud computing technology. In this model, payroll software is hosted on secure, remote servers managed by a third-party provider. Users access the platform via the Internet, eliminating the need for local installations or dedicated IT infrastructure. This approach allows both payroll managers and employees to handle payroll tasks from anywhere with an internet connection [2] , [3] .

Key Characteristics of Cloud Payroll Technology

- Hosted Remotely : Software runs on off-site servers, maintained by the provider.

- Internet-Based Access : Users log in via a secure web browser interface.

- SaaS Model : Subscription-based, with automatic updates and maintenance handled by the vendor.

This setup ensures maximum flexibility, scalability, and access to the latest compliance and security updates without manual intervention [5] .

Core Features of Cloud-Based Payroll Systems

Cloud payroll platforms deliver a comprehensive suite of automated features designed to simplify payroll management and reduce human error. Common functionalities include:

- Automated Wage Calculations : Computes salaries, overtime, bonuses, and deductions in real time.

- Tax Compliance Management : Updates automatically to reflect changing tax laws and ensures accurate withholding [2] .

- Direct Deposit & Payment Processing : Facilitates timely, secure payments to employee bank accounts [3] .

- Employee Self-Service Portals : Allows employees to view pay stubs, update personal details, and download tax forms online [5] .

- Real-Time Reporting & Analytics : Generates up-to-date reports on payroll expenses, tax liabilities, and compliance status for better decision-making [1] .

- Data Security : Incorporates encryption, secure authentication, and regular backups to protect sensitive payroll information [2] .

- Integration Capabilities : Seamlessly connects with HR, time-tracking, and accounting tools to eliminate data silos [5] .

Benefits of Using Cloud-Based Payroll Technology

Businesses that implement cloud payroll solutions experience a wide range of operational and strategic advantages:

1. Enhanced Accuracy and Error Reduction

Automated calculations minimize manual input errors. According to the American Payroll Association, businesses using cloud payroll report up to a 30% reduction in payroll mistakes [2] .

2. Real-Time Accessibility and Flexibility

Payroll staff and employees can access the system from any device, anywhere. This is especially valuable for organizations with remote or hybrid workforces.

3. Automatic Compliance Updates

Cloud payroll systems automatically adapt to changes in tax codes and labor regulations, reducing compliance risk and administrative burden [1] .

4. Scalability for Growing Businesses

Cloud solutions easily scale to accommodate changing business needs, from adding new employees to expanding into new regions [5] .

5. Cost Savings and Resource Optimization

By moving payroll to the cloud, companies reduce IT infrastructure expenses, minimize manual paperwork, and free up staff for higher-value tasks [3] .

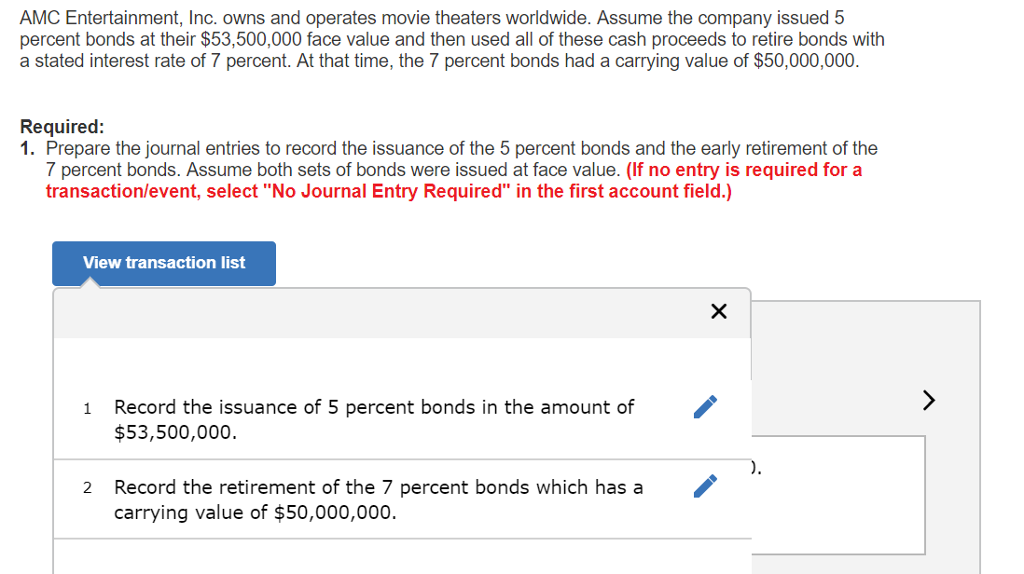

How to Implement a Cloud-Based Payroll System: Step-by-Step Guidance

Transitioning to a cloud-based payroll system is a strategic process that involves careful planning and execution. Here is a step-by-step guide to help you get started:

Source: demotix.com

Step 1: Assess Your Payroll Needs

Evaluate your current payroll processes, pain points, and compliance requirements. Identify features critical to your business, such as multi-state tax support or employee self-service options.

Step 2: Evaluate Cloud Payroll Providers

Research vendors that offer established, reliable cloud payroll solutions. Consider factors such as data security certifications, integration capabilities, scalability, and customer support. Look for independent reviews and case studies to verify the provider’s track record.

Step 3: Prepare for Data Migration

Work with your selected provider to plan a secure migration of payroll data from legacy systems. Ensure data backup and validation procedures are in place to prevent information loss.

Step 4: Configure and Customize the System

Set up the new payroll platform to match your organization’s policies and compliance requirements. Customize workflows, add users, and integrate with HR, time-tracking, or accounting systems as needed.

Step 5: Train Staff and Employees

Conduct training sessions for payroll administrators and employees. Provide clear instructions on accessing pay stubs, updating details, and using self-service features. Ongoing support is essential to ensure a smooth transition.

Step 6: Go Live and Monitor Performance

After thorough testing, launch the new system. Monitor operations closely during the first few payroll cycles to identify and resolve any issues promptly. Use built-in analytics to track key metrics, such as processing time, error rates, and employee satisfaction.

Real-World Example: Cloud Payroll in Action

Consider a mid-sized retail company with multiple locations and a distributed workforce. Before adopting cloud-based payroll, the company struggled with manual data entry, compliance errors, and delayed payments. After switching to a cloud payroll provider, they reported:

- 30% fewer payroll errors within the first quarter

- Significant reduction in administrative time spent on payroll

- Improved employee satisfaction due to easy access to pay information

- Enhanced compliance with tax and labor laws across state lines

This example illustrates how cloud payroll technology can drive tangible improvements in efficiency and compliance [2] .

Potential Challenges and Solutions

Data Security Concerns

Some businesses worry about storing sensitive payroll data in the cloud. Leading providers address this with advanced encryption, multi-factor authentication, and regular security audits. Always verify the provider’s security credentials and compliance with data protection regulations [5] .

Integration with Existing Systems

Integrating cloud payroll with legacy HR or accounting systems can be complex. Many platforms offer APIs and pre-built connectors to simplify this process. Consult your vendor about integration options and conduct thorough testing before going live.

User Adoption Resistance

Change management is crucial. Provide detailed training, clear documentation, and ongoing support to help staff and employees adjust to the new system.

Alternatives and Future Trends

While cloud-based payroll (SaaS) is the most common model, some organizations may consider private cloud or on-premises solutions for highly sensitive or regulated environments. However, these alternatives typically require greater IT investment and maintenance.

Emerging trends in cloud payroll include AI-driven analytics, predictive compliance tools, and deeper integrations with workforce management platforms. Keeping up with these innovations can further streamline payroll operations and improve business agility [1] .

How to Access and Get Started with Cloud Payroll Solutions

To begin using a cloud-based payroll system, you can:

- Research reputable providers such as ADP, Paychex, Gusto, or isolved HCM. Visit their official websites and request a product demonstration.

- Consult with your HR or IT department to assess readiness and integration requirements.

- Contact industry peers or professional associations for recommendations.

- Search for independent reviews and case studies to evaluate each provider’s strengths and weaknesses.

- Ensure the provider offers robust customer support, data security certifications, and compliance with relevant labor laws.

If you require specific features, such as international payroll or industry-specific compliance, include those criteria in your search. You may also wish to engage a payroll consultant or technology advisor to guide the selection and implementation process.

Key Takeaways

When a company uses a cloud-based payroll system, it is leveraging Software as a Service (SaaS) -a cloud computing model that delivers powerful, secure, and flexible payroll management accessible from anywhere. The benefits include increased accuracy, cost savings, real-time access, compliance, and scalability. By following structured implementation steps and carefully selecting a trusted vendor, businesses can unlock the full potential of cloud payroll technology and focus more on growth and innovation.

References

[1] Matellio (2024). Why Cloud-Based Payroll Software is a Must-Have for Modern Businesses.

[2] Lift HCM (2024). Transform Your Payroll Processing with Cloud Technology.

[3] EmployBorderless (2025). Cloud-Based Payroll Software: Definition, Features, Benefits.

[4] Lift HCM (2024). The Game-Changing Benefits of Cloud-Based Payroll for Modern Businesses.

Source: sumopayroll.com

MORE FROM couponnic.com